Author:Trend Research

Since the market crash on October 11th, the entire crypto market has been sluggish, with market makers and investors suffering significant losses. The recovery of capital and sentiment will take time.

However, the crypto market is never short of new fluctuations and opportunities, and we remain optimistic about the future market.

This is because the trend of mainstream crypto assets integrating with traditional finance to form new business models has not changed; instead, it has been rapidly building moats during the market downturn.

1. Wall Street Consensus Strengthens

On December 3rd, U.S. SEC Chairman Paul Atkins stated in an exclusive interview with FOX on the New York Stock Exchange: "In the coming years, the entire U.S. financial market may migrate to the blockchain."

Atkins mentioned:

(1) The core advantage of tokenization is that if assets exist on the blockchain, the ownership structure and asset attributes will be highly transparent. Currently, publicly traded companies often do not know who their shareholders are, where they are located, or where the shares are held.

(2) Tokenization also has the potential to achieve "T+0" settlement, replacing the current "T+1" trading settlement cycle. In principle, the delivery-versus-payment (DVP)/receive-versus-payment (RVP) mechanism on the blockchain can reduce market risks and improve transparency. The time gap between clearing, settlement, and fund delivery is currently a source of systemic risk.

(3) He believes tokenization is an inevitable trend in financial services, and mainstream banks and brokerages are already moving toward tokenization. The world may not even need 10 years... perhaps it will become a reality in just a few years. We are actively embracing new technologies to ensure the U.S. remains at the forefront in areas like cryptocurrency.

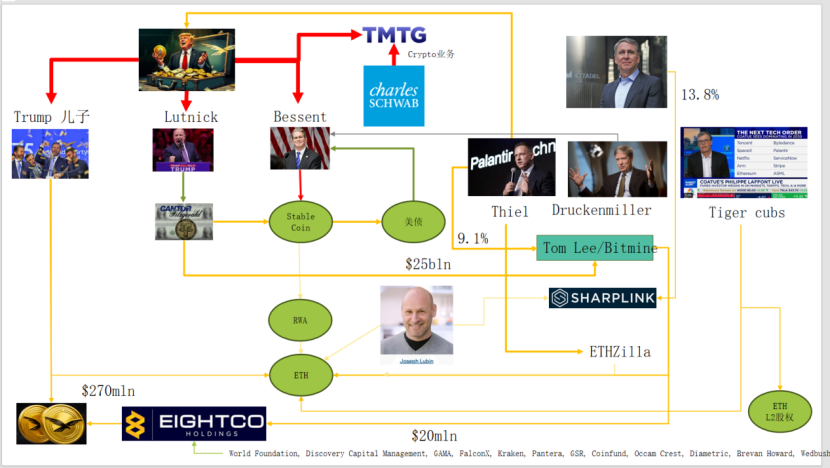

In reality, Wall Street and Washington have already built a deep capital network for crypto, forming a new narrative chain: U.S. political and economic elites → U.S. bonds (Treasury bonds) → stablecoins / crypto treasury companies → Ethereum + RWA + L2

This diagram shows the intricate connections between the Trump family, traditional bond market makers, the Treasury Department, tech companies, and crypto companies, with the green elliptical links forming the backbone:

(1) Stablecoins (USDT, USDC, dollar assets behind WLD, etc.)

The majority of reserve assets are short-term U.S. bonds + bank deposits, held through brokers like Cantor.

(2) U.S. Treasury Bonds

Issued and managed by the Treasury / Bessent side.

Used by Palantir, Druckenmiller, Tiger Cubs, etc., as low-risk interest rate base holdings.

Also the yield assets pursued by stablecoins / treasury companies.

(3) RWA

From U.S. bonds, mortgages, and accounts receivable to housing finance.

Tokenized through Ethereum L1 / L2 protocols.

(4) ETH & ETH L2 Equity

Ethereum is the main chain for RWA, stablecoins, DeFi, and AI-DeFi.

L2 equity / tokens represent claims on future transaction volume and fee cash flows.

This chain illustrates:

U.S. dollar credit → U.S. bonds → stablecoin reserves → various crypto treasury / RWA protocols → ultimately settled on ETH / L2.

In terms of RWA TVL, compared to other public chains that declined during the October 11th crash, ETH is the only public chain that quickly recovered and rose. Its current TVL is $12.4 billion, accounting for 64.5% of the total crypto market.

2. Ethereum Explores Value Capture

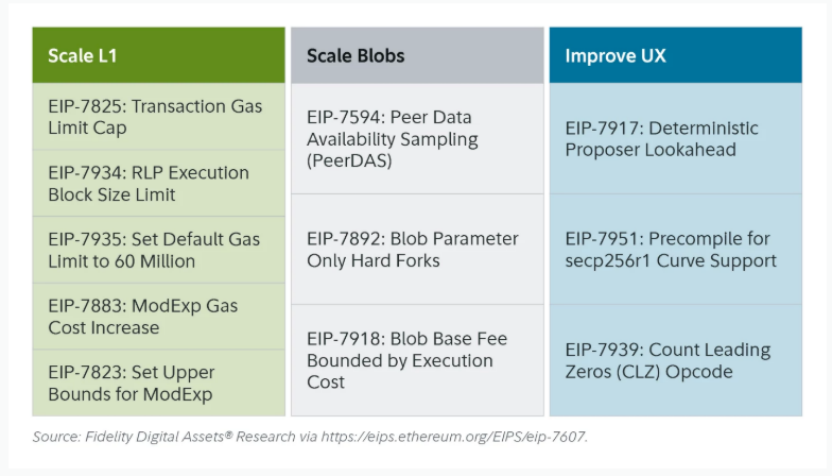

The recent Ethereum Fusaka upgrade did not cause much stir in the market, but from the perspective of network structure and economic model evolution, it is a "milestone event." Fusaka is not just about scaling through EIPs like PeerDAS but also attempts to address the issue of insufficient value capture on the L1 mainnet caused by L2 development.

Through EIP-7918, ETH introduces a "dynamic floor price" for blob base fees, tying its lower limit to the L1 execution layer base fee. This requires blobs to pay at least approximately 1/16 of the L1 base fee for DA costs. This means Rollups can no longer occupy blob bandwidth at near-zero costs indefinitely, and the corresponding fees will be burned, flowing back to ETH holders.

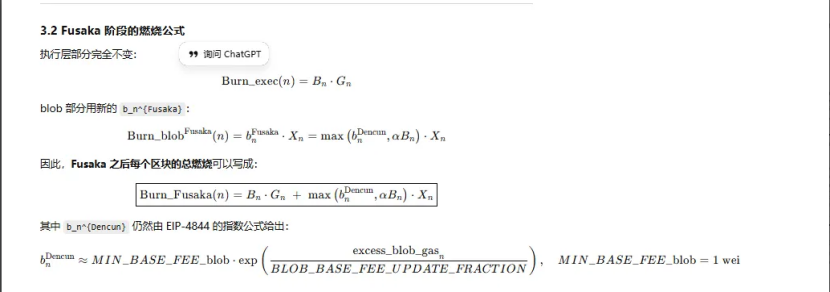

There have been three upgrades related to "burning" in Ethereum:

(1) London (single-dimensional): Only burns the execution layer. ETH begins to experience structural burning due to L1 usage.

(2) Dencun (dual-dimensional + independent blob market): Burns execution layer + blob. Writing L2 data to blobs also burns ETH, but during low demand, the blob portion is almost zero.

(3) Fusaka (dual-dimensional + blob bound to L1): Using L2 (blob) requires paying at least a fixed proportion of the L1 base fee, which is burned. L2 activity is more stably mapped to ETH burning.

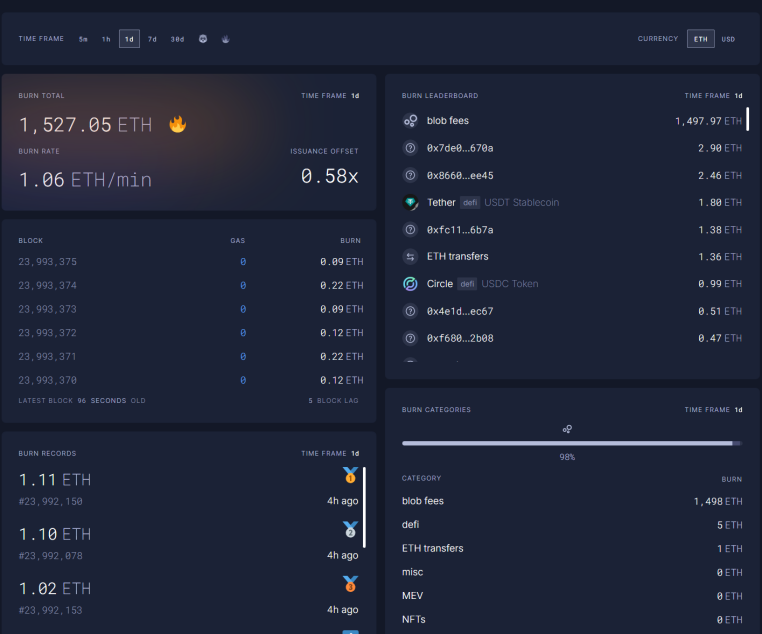

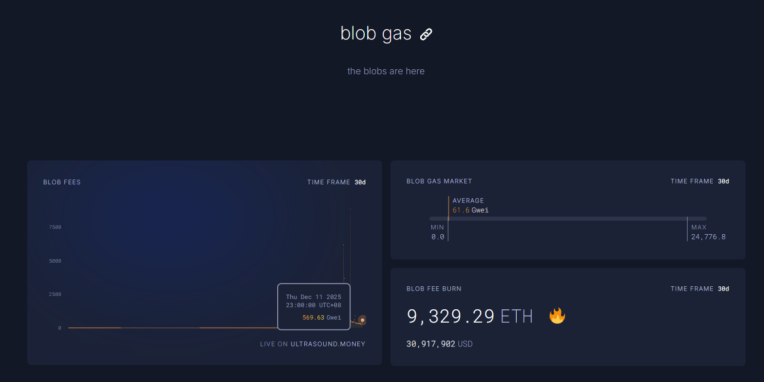

As of December 11th, 23:00, the 1-hour blob fees have increased by 569.63 billion times compared to pre-Fusaka upgrade levels, burning 1,527 ETH in one day. Blob fees now contribute the highest proportion to burning, accounting for 98%. As ETH L2 activity further increases, this upgrade is expected to return ETH to a deflationary state.

3. Ethereum Technicals Strengthen

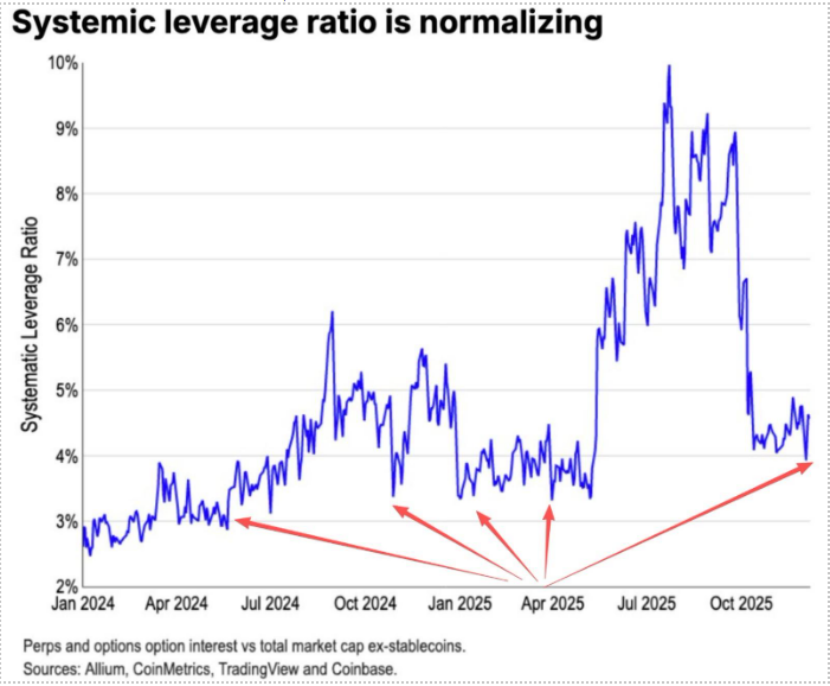

During the October 11th crash, ETH futures leverage was thoroughly cleared, eventually affecting spot leverage. Many long-time OGs reduced their holdings due to weakened faith in ETH. According to Coinbase data, speculative leverage in the crypto space has dropped to a historically low level of 4%.

In the past, a significant portion of ETH short positions came from traditional Long BTC/Short ETH paired trades, which generally worked well during bear markets. However, this time, an unexpected change occurred. The ETH/BTC ratio has maintained a sideways resistance trend since November.

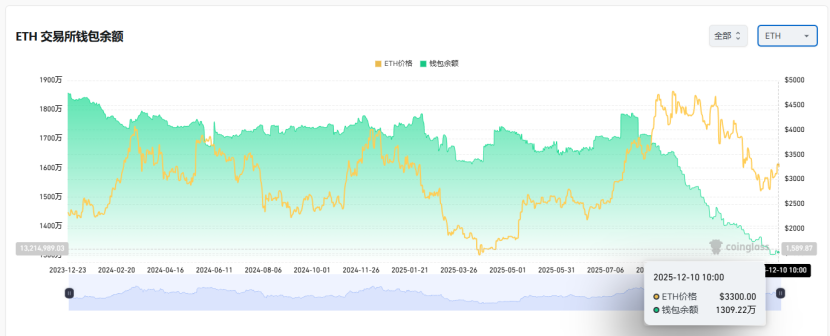

ETH exchange reserves now stand at 13 million coins, about 10% of the total supply, which is at a historical low. As the Long BTC/Short ETH pairing has failed since November, a "short squeeze" opportunity may gradually emerge during extreme market panic.

As we approach 2025–2026, both U.S. and Chinese monetary and fiscal policies have released friendly signals:

The U.S. is expected to pursue tax cuts, interest rate reductions, and relaxed crypto regulations, while China will adopt appropriate easing measures and financial stability (suppressing volatility).

Amid relatively loose expectations from both the U.S. and China and scenarios of suppressed downward asset volatility, ETH remains in a favorable "buying sweet spot" during extreme panic and while capital and sentiment are not fully recovered.